Blogs

Archives

New Software - Apxium - 9th July 2024

Morning all, trust you're well. I recently emailed our clients with monthly fee arrangements to advise of a change to our billing software. We are now rolling this new software out to all clients.

We are changing software companies and moving from Ignition to a new provider called Apxium (pronounced Apps-ium).

Used by many accounting firms and businesses, Apxium is an end-to-end receivables solution that brings a host of benefits. Our experiences with it to date have been positive, and it will significantly enhance our service to you

Read More

AVCA Alert- The Australian Taxation Office (ATO) has intenisified its efforts in pursuing tax debts. - 26th March 2024

We are reaching out to inform you of a significant development in the taxation landscape that could impact your financial affairs.

The Australian Taxation Office (ATO) has intensified its efforts in pursuing tax debts. It signals a significant shift in its approach.

ATO's Aggressive Pursuit of Tax Debts

Recent reports and observations within the Accounting and Tax industry indicate that the ATO has ramped up its enforcement activities, particularly in recovering outstanding tax debts.

This heightened focus is part of the ATO's broader strategy to collect a whopping $15bn in outstanding tax debts, to ensure compliance with all tax obligations and to maintain the integrity of the tax system.

Read More

Australian Taxation Office Client to Agent Linking commenced From 13 November 2023 - 13th November 2023

The ATO are further strengthening the security of online services to help protect against fraud and identity related theft.

From 13 November 2023, all types of entities with an ABN (excluding sole traders) will need to nominate a Tax Agent, a BAS Agent or a Payroll Service Provider before they can act for you ** and on your behalf.

Please note existing clients are not affected by this system unless you ask us to take on an additional role. Keep reading for more info.

Read More

AVCA moving to MYOB's GreatSoft - 16th October 2023

This is a just a quick note

to let everyone know that we are in the process of changing software. We have

outgrown MYOB Accountants Enterprise (AE) and have moved to MYOB's

GreatSoft platform. It will allow us more cloud based functionality and integration.

The changeover process was long and time consuming with many of the

administrative team spending weeks on getting our data base cleaned up for the

changeover.

A Reminder About the $1,000 SafeWork Small Business Rebate - 31st August 2023

The NSW Government has reminded small businesses to apply for a $1,000 SafeWork Small Business Rebate. Introduced in October 2018, this scheme is to assist small businesses with the cost of their workplace health and safety costs.

*** BREAKING NEWS *** CHANGE OF OFFICE HOURS - WARATAH AND MAITLAND - 25th October 2022

There is no doubt the recent COVID pandemic had us reassessing a lot of what works and what does not work in our lives. Following feedback from my key staff, we have decided to change the office hours at both our Waratah office and our Maitland office.

A Known Glitch in the Matrix and an Update to our Lodgement Extension Request - 25th July 2022

A Known Glitch in the Matrix and an Update to our Lodgement Extension Request

Businesses: How to Setup Access to your own ATO Online Services - 28th June 2022

Did you know you can setup access to your own

ATO Online Service? ATO Online Services provides businesses access to a range

of secure tax and superannuation services all in one place.

Jenny Aitchison - Parliament Acknowledgement Tony Vidray 40 years of Service - 5th April 2022

Reminder on Director Identification Numbers (DIN's) - 5th April 2022

You may

recall our newsletter on this topic sent in November 2021. This update is to remind you all that IF you want to added as a Director to a company on or after

05 April 2022, you will need a DIN before your appointment.

NSW Business Support 2022 - 31st January 2022

NSW Business Support

The NSW Government has announced a $1bn support

package for struggling NSW small businesses.

No RST for the Wicked The End of Paper from the ATO - 14th January 2022

The Australian

Taxation Office (ATO) announced in March 2020 that they were going to cease

sending paper activity statements. This applies to forms R, S and T.

Lockdown Support Update July 2021 - 21st July 2021

To help keep

you up to date with lockdown support that is available for you and your

business, we have compiled this comprehensive guide:

Everything Is Just Super - 27th June 2021

Since our recent newsletter

on changes happening from 01 July 2021, our office has received a number of

enquiries around superannuation, so I thought I would send out an update

sharing a few of the questions asked and some of the misunderstandings in the recent

announcements.

Five Ways to Bring in More Cash for Your Business - 6th January 2021

Now is the perfect time to evaluate your financial position

and come up with innovative ways to add revenue streams and generate cash. Here

are five ways you might consider to improve your cash inflow:

NSW Government Actions - 10th November 2020

The

NSW Government unveiled their 20-Year Economic Vision to set out a

clear pathway for ensuring that Regional NSW will continue to be a vibrant and

growing part of our economy, and that people are supported in their decision to

live in the regions.

The Vision is currently being refreshed to incorporate the challenges and

opportunities for regional NSW associated with the impacts of the drought,

bushfires and COVID-19.

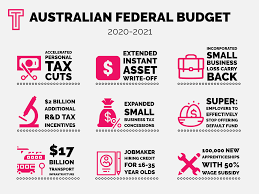

The 2020-2021 Federal Budget - 12th October 2020

Last Tuesday the Federal Government delivered the 2020-2021 Federal Budget and more importantly, by Friday it has been passed by both Houses of Parliament.

Jobkeeper Extension Bill - 28th August 2020

The JobKeeper Payments Amendment Bill was introduced in the House of Representatives on

Wednesday 26th August. We appreciate your patience as we process these changes.

9 Steps to Leading People Successfully through Major Change - 13th July 2020

Change in

business is almost always a good thing, but often poor management means that

the workforce becomes disengaged and the change process painful. In the

worst cases, this results in irreparable damage being done.

It doesn't need

to be this way. Follow these nine steps and empower yourself to successfully

lead your people through major organisational change.

Beyond COVID-19 - How to build value in your business - 1st June 2020

We've said it before and we'll say it again - this has been an extremely difficult few months for all of us, but there is no better time to think seriously about your business. In this article, we have compiled a few tips to create value in your business.

Ways to run your business if you can't open your premises - 30th April 2020

The COVID-19 pandemic has proven challenging for

many small business owners. It's difficult to run your business remotely, especially

if you're not set up to do so. If you run a business that requires customers or

clients to come to you, you might be very concerned about how you can continue

to operate without opening your premises.

If you have access to technology, are adaptable, and

are willing to look into financial assistance, you can make it through this

pandemic. Here are some ways to keep your business operational through

COVID-19.

4 Tips for Getting Your Business Through Tough Times - 31st March 2020

If you're a small business owner whose company

hasn't gone through hard times, that's great but it's likely to happen at some

point. As much as we dream about being brilliant enough at business that we'll

never face slow times, there are many things beyond our control that can negatively

affect our business.

It's highly likely that the Coronavirus and it's

resulting impacts, could put some significant pressure on your business.

Read More

Your March 2020 BAS will be the most important BAS ever - 26th March 2020

For those businesses that have an Australian Business Number (ABN) and were registered for the Pay As You Go system for Wages (PAYG W) as at 12 March 2020, your March 2020 Business Activity Statement (BAS) will be the most important BAS you lodge in a long time.

Economic stimulus package - Round Two - 23rd March 2020

We hope you remain well and are managing to navigate the changing landscape of business in Australia.

As you are aware, the current environment with Coronavirus is constantly evolving and as such we are committed to keeping you updated as changes occur.

Further to our email of last week, here are some further resources to assist you through these unprecedented times:

COVID-19 update: support resources - 19th March 2020

We sincerely

hope you are well and coping with the dynamic and rapidly changing

circumstances around the Coronavirus. Rapid change can often bring uncertainty,

worry, concern and anxiety.

We have been monitoring the advice given by the Australian Government and health authorities closely to provide you with information and resources that can help support your business during this time.

There is much going on and changes occurring daily so we will endeavour to keep you updated in regard to continuing support for your business, you and your families.

Read More

Upcoming Tax and Compliance Changes - 21st January 2020

Welcome to 2020! As I type the year 2020, its still seems futuristic to me, but here we are, a new year and depending on your point of view, a new decade.

There are some significant changes that will be occur this year and some new technologies implemented. Here's a summary for you:

Australian Bushfires - support and resources availble - 15th January 2020

During recent months, Australia has experienced one of the most devastating fire seasons on record. Thousands of people have been displaced, natural habitats have been destroyed, businesses crippled and sadly there has also been tragic loss of life.

Our heartfelt thoughts rest with those that have been affected during these harrowing events.

If you or your business have been impacted by the recent fires, there are a range of resources available to assist.

How to get your life back in a seven-day-a-week business - 10th October 2019

Small

business owners already have a difficult and time-consuming job running their

business. If their business is open five days a week, they usually need the

weekend to catch up on paperwork, pay bills and manage any tasks they didn't

get to during the week.

For those

with a seven-day-a-week business, there's even less time off. They often feel

the need to be onsite any time the business is open, to deal with unanticipated

issues, help the staff out, and ensure all tasks are completed.

Here are

three tips for getting your life back when you operate a seven-day-a-week

business.

What you need to do before you retire - 16th September 2019

Most people dream about the day they no longer

have to work. They dream of having a leisurely coffee in the morning without

running to a meeting or they want to spend six months of the year visiting

exotic locations. Being able to do so requires planning. It means you have to

think about your financial future and take steps to make sure you can afford

the lifestyle you want to live. Here are some things

to do before you retire.

Three reasons why you need small business insurance - 15th August 2019

If your small

business operates on a tight budget you might be tempted to eliminate costs

that you think aren't necessary. Often small business owners choose to go

without business insurance as a way of saving money, but doing so can be

incredibly costly in the long run. Here are three

reasons you need small business insurance.

3 Mistakes That Strangle Growing Businesses - 17th July 2019

Businesses want to

grow and help a larger audience, but too many make mistakes that cripple their

growth. Even worse, they keep repeating them! Here's how to avoid the basic business blunders.

Single Touch Payroll - Final Reminder! - 28th June 2019

As you would be aware by now, Single Touch Payroll (STP) is only a few days away from being operational for employers who employ 19 or fewer employees.

Read More

Smart Money Tips for Business Owners - 18th June 2019

Small business owners know how important it

is to save money. They know that one day that dollar could come in handy,

especially during slower times.

Saving money is definitely important, but

there are also things small business owners can - and should - spend their

money on today. It might seem counterproductive to spend money when you want to

put it in the bank - and make no mistake, saving and investing are also vital - but sometimes spending your money can wind up helping your business immensely,

protecting it from slower times.

Here are three things smart business owners

spend their money on.

Records for Claiming Work-related Expenses - 6th June 2019

When completing your tax return, youre entitled to claim

deductions for some expenses, most of which are directly related to earning

your income.

A Commonly Forgotten Tax Deduction - 9th May 2019

There is one tax deduction which affects many of us as professionals, business or trades people will be members of an association, that is commonly forgotten.

Read More

Guide to Making Motor Vehicle Expense Claims - 12th February 2019

A perennial topic regarding tax deductions is claiming expenses for a car. The following notes summarise the most salient points when it comes to claiming a deduction for motor vehicle expenses. Of course every person's circumstances may be different, but the following covers most of the relevant information.

Key points to keep in mind include:

Read More

What to do if you get audited - 28th November 2018

No business owner looks forward to a letter from the taxman requesting a closer look at the books.

If you've received an audit letter - an official request by the tax authority to review your accounts and confirm your taxes have been paid to date - don't panic. Prepare.

These four steps will help you get through the process with minimal stress and the best possible outcome.

10 Tips to Reduce Debtor Days for Small Business Owners - 13th November 2018

Steady, reliable cash flow is crucial for the

survival of any small business - so taking steps to ensure your customers pay promptly

should be a key priority.

When your clients consistently pay on time, you'll avoid

the dreaded "feast or famine" cycle. You'll be able to pay your vendors,

suppliers, and employees on time - and not least of all, yourself.

Implement these ten tips now to start getting paid

without delay.

The Work Christmas Party - 5th November 2018

It's not quite Christmas time yet, but most businesses will be in the process of thinking ahead to the yuletide festivities, if not already into well-advanced planning. One of the perennial questions is if and how fringe benefits tax applies to these activities.

Are You Falling Behind By Not Automating These Business Activities? - 23rd October 2018

The daily processes and transactions involved in operating a business can mean long hours of repetitive tasks and occasional oversights due to human nature. Automating these tasks can result in significant savings in resources and eliminate mistakes caused by human error. The key, however, is to know which tasks should be automated and which ones warrant staff intervention and guidance.

Here are six activities

that you should definitely be automating for your business.

Can Claims be Made for Home Office Expenses When it's Located Overseas? - 11th September 2018

A question was asked of the ATO recently, via its "ATO Community" webpage that centred on the eligibility of a taxpayer to make deduction claims for home office expenses. While it is a question that would not generally warrant extensive clarification, the fact that the home office in question was located offshore made the query somewhat unique.

MYOB Set to Scrap Accounting Desktop Product - 11th September 2018

AccountRight Classic, which has been in the market for about 20 years and is one of MYOB's original desktop products, won't be updated beyond September 30 next year.

For those who want up-to-date support and systems beyond September 2019, this will mean an upgrade to MYOB's cloud-based suite of products.

So now is the time to look to transition to the cloud. If you are unsure how to implement this transition, we can help.

Family & Domestic Violence Leave - 7th August 2018

Following a recent

Fair Work Commission (FWC) Full Bench Decision (See: [2018] FWCFB 3936) all employees who

are covered by an industry or occupation modern award may now take up to

five days of unpaid leave to deal with family and domestic violence (Family

and Domestic Violence Leave) per each 12 month period.

Claiming Self-Education Expenses - 6th August 2018

Changing technology and evolving workplaces means that at some stage in every taxpayer's life, an educational re-boot could become necessary - as the adage says, "you're never too old to learn". Therefore supplementary education mid-career is a valuable, and hopefully an income-boosting, pursuit.

10 Productivity Tools to Help You Do More at Work - 25th July 2018

Productivity

is a difficult thing to master. These ten tools will help you along

your journey and allow you to reclaim some of your valuable time.

Tax Lessons from the Football (Soccer) World Cup - 4th July 2018

Being an avid soccer fan, I have been up regularly in recent weeks in the wee hours of the morning, sadly watching the Socceroos early exit from the competition.

Read More

Tips for Tax 2018 - 3rd July 2018

Before

coming in for your tax appointment here are the sorts of information needed to

enable us to complete your tax return.

Why Your Business Needs You to Say No - 26th June 2018

Being open to new possibilities is a positive trait shared

by most entrepreneurs - but saying yes to all the people you meet and

opportunities that come your way can get you into trouble.

One of the most impactful changes you can make in your business is to form one simple

habit: give yourself time to weigh the cost and benefit before making any decision,

and politely decline any opportunity that doesn’t align with your goals.

If you're feeling stressed and less productive than you'd like, it's time to

get better at saying no. Here's how.

Managing Tax Disputes Can Be Like Wrestling With a Superhero - 13th June 2018

It is sometimes said that a

superhero like the DC Comics character Superman can be an uninteresting

character because he is, for all practical purposes, indestructible. Critics

have said the knowledge that he will most likely win can make Superman's

adventures monotonous.

A similar accusation could

be levelled at the Federal Commissioner of Taxation (the flesh and bone

personification of the ATO).

But despite all his powers,

our real life superhero (or supervillain, depending on where you stand) can

sometimes be successfully opposed, if not entirely defeated. But to do this you

must move quickly, know the rules of engagement and have a clear vision of the

outcome.

Builders: Get Your Taxable Payments Report Ready Before August 28 - 13th June 2018

Businesses in the building and construction industry, take note - the deadline is August 28, 2018 to report the total payments you made to each contractor you enlisted the services of in 2017-18. You will need to report these payments to the ATO on the Taxable payments annual report.

Home to Work Travel Claims? Generally not but Sometimes..... - 4th June 2018

As

a general rule, travel from your home to your workplace is not allowed

as a deduction because it constitutes a "private expense". There are

however specific situations where this rule may not apply, and there can be

circumstances where you may be entitled to claim some of the travel expenses

between your home and your regular workplace, or even your alternative

workplace.

But

it is a minefield that needs to be treaded carefully so as to not end up in hot

water with the taxman.

How To Let a Client Go - 28th May 2018

Ask

anyone who's been self-employed for a few years. By and large, the vast

majority of clients are great. The less than ideal ones, however, can become a

serious liability.

Problem clients come in all shapes and sizes. There are the late payers and

scheduled "no shows". The ones who are demanding and don't respect your time.

Remember, just because you need to earn a profit doesn't mean it's in your best

interest to serve everyone who walks in the door.

Here

are a few ways to respectfully let go of clients who aren't an asset for your

business.

Protect Yourself and Your Data - Proactive Steps for Living Safely in the Digital Age - 22nd May 2018

These

days your personal data is everywhere, and that information is valuable to

marketers, hackers and everyone in between. If you want to prevent the

unauthorised use of your personal information, you need to take a proactive

approach to protecting yourself and your identity.

Read More

Tips for More Productive Meetings - 7th May 2018

Increasing efficiency and minimising costs are

essential to running a profitable business. Yet many small business owners

waste countless hours on meetings that lack focus, run on too long, and pull

staff away from more productive tasks.

Follow these seven tips to make your meetings more efficient and

cost-effective.

Company Directors: Do you REALLY Know Your Responsibilities? - 2nd May 2018

As

anyone running a business knows, commercial decisions must be made, and many

times these decisions involve some degree of risk. While the distinction

between entrepreneurial freedom and delinquent corporate behaviour will be

clear cut for most company directors, there are nevertheless circumstances

where these lines can blur, resulting in sometimes substantial (and sometimes unexpected)

personal exposure.

Dealing with Tax and Renting via Airbnb - 23rd April 2018

Airbnb

is one of many examples of the "sharing economy" - connecting buyers (users)

and sellers (providers) through a facilitator that usually operates an app or a

website. Airbnb acts as this facilitator by allowing individuals, referred to

as "hosts", to rent out a room of their house or their whole house for a

short-time basis via its online platforms.

While

the focus here is on Airbnb, the tax concepts outlined could be applied in a

more general sense to anyone seeking to rent out a part of their home, whether

through Gumtree, Realestate.com.au, Flatmates.com.au and so on.

Is Technology Making You Less Efficient? - 17th April 2018

"For a list of all the ways technology has failed to improve the quality of life, please press three". - Alice Kahn

If you feel overwhelmed by the sheer volume of technological gadgets out there, never mind apps and other digital "solutions", you're not alone. Technology sprawl and the rabbit hole of more and more information, available all the time, is making productivity - and healthy downtime - a real challenge for many of us.

Although we may be quicker at completing redundant tasks, more time is wasted managing all our different apps and technologies - and more of us live in a near constant state of distraction.

Read More

Personal Risk to Managers and Business Owners who Underpay Employees - 17th April 2018

Managers and business owners who underpay employees are increasingly at risk of being fined personally if they underpay employees. More often than in the past, the Fair Work Ombudsman [FWO] is prosecuting individual company directors and managers (including HR managers) where the businesses they own or manage have underpaid employees.

Read More

So You've Launched Your Business - Now What? - 10th April 2018

Good news for small business owners: according

to the US Small Business Administration, nearly 80% of small businesses survive their first year.

However, that number begins to drop as time rolls on. Only half of small

businesses pass the five year mark, and a mere third celebrate their tenth

anniversary.

Taking steps to create a good foundation in the early days of your business is

essential for a sustainable and profitable future. Here's how.

Bitcoin: Its place in your wallet or SMSF portfolio - 4th April 2018

While bitcoin may be the most well-known cryptocurrency, there are nearly 1,500 in

existence. In its simplest form, a

cryptocurrency is a "peer-to-peer electronic cash system", which means that the

currency is not in a physical form like cash but sits in an electronic

register.

Small Business Stamp Duty Exemption - 27th March 2018

The NSW Government has

created a new Small Business Stamp Duty exemption (the exemption) for certain

insurances acquired on or after 1

January 2018.

Currently all

commercial insurance policies attract Stamp Duty which is imposed by the State Government.

For eligible small businesses, this means that there is no longer a requirement

for this cost to be paid.

Solicitor Trust Account Audits - 26th March 2018

Are you a solicitor who requires an External Examination of your Trust Account?

Common Errors with Fuel Tax Credits and How to Avoid Them - 7th March 2018

Fuel tax credit rates are updated every year

(generally on 1 February, but for 2018 they changed on 5 February). It is therefore a

timely reminder that the ATO has made public some common errors that taxpayers make when

calculating and claiming fuel tax credits.

The tips that follow will help taxpayers avoid

these errors, or you can watch this webinar recording for more information on getting fuel tax

credit claims right.

Is your Business Prepared for Single Touch Payroll? - 5th March 2018

Single

Touch Payroll is a government initiative to streamline business reporting

obligations, which is due to become compulsory from 1 July 2018. When a

business pays its employees, the payroll information will be sent to the ATO

via the business's payroll software.

Reporting

under the Single Touch Payroll (STP) system removes the requirement to issue

payment summaries, provide annual reports and tax file number declarations to

the ATO. During the first year of its introduction, the ATO says employers will

not be liable for a penalty for a late STP report.

Read on for Important

points to keep in mind for the transition to STP.

Capital Works Deductions for Rental Property - 14th February 2018

Rental property investors can claim capital

works deductions for construction costs for a rental property, however there

are limits imposed in relation to the dates such works were completed.

Rental Property Owners Lose Some Deductions - 7th February 2018

Legislation

that came into law in the last half of 2017 makes certain measures first

announced with the 2017 Federal Budget now a reality.

The "housing tax integrity" bill solidifies the government's intention to deny all

travel deductions relating to inspecting, maintaining, or collecting rent for a

residential investment property. As well, second-hand plant and equipment that

came with an investment property are now off the table as far as depreciation

goes.

The

measures will apply from July 1, 2017, so will affect returns for the

current financial year. However the changes to depreciation are dependent on

when assets were purchased (more below).

Having Fun AND Making Money. But is it a Business or a Hobby? - 7th February 2018

It may seem fairly obvious whether a

person is in business or not, but the distinction can be important for other

reasons. You may be having fun AND making money, but is it a business

or a hobby?

Yellow Pages vs Facebook Ads - Should you Cancel your Print Listing? - 22nd January 2018

If you're a small business owner with a modest

marketing budget, every dollar you spend has to be worth the investment.

Ideas for Business Goals in 2018 - 9th January 2018

The start of the year is the perfect time to dust off last year's business plan and set some new goals for the future.

Tips for Getting Rid of Slow Moving Stock - 13th December 2017

Stale inventory is a costly nuisance for any business owner.

Ideally the rule of thumb is to sell the goods taking up space on your sale

floor within 90 days; after the three month mark stale inventory becomes dead

inventory. Products are much harder to move and nearly impossible to get top

dollar for.

Fortunately there are a number of ways to recoup at least part of your

investment on old, slow-moving stock. Get rid of your old inventory with these

six tried and true ideas.

Ordinary Time Earnings: What's In, What's Out - 6th December 2017

The superannuation rules stipulate that an employee's earnings base must be the amount on which minimum superannuation contributions are payable to avoid the superannuation guarantee charge (SGC). This earnings base is determined as "ordinary time earnings" (OTE).

Just to clarify, here are the remuneration elements that are (and are not) included.

GST and the Buying or Selling of Real Estate Premises - 4th December 2017

Whether

a sale of property is subject to GST will be dependent on a number of factors.

The sale of real property must be made in the course or furtherance of an

enterprise before it is brought into the GST system.

Read on for further information.

Read More

The Ins and Outs of "Entertainment" Business Deductions - 4th December 2017

As a tax concept, "entertainment" can be relevant not only to fringe benefits tax (FBT), but also to income tax

and even goods and services tax (GST). For a business, whether a business

expense is "entertainment" will generally also determine whether the cost is

deductible. If the expenditure can be shown to be directly connected with the

carrying on of a business, it should be deductible.

Newcastle Retailer Scoops Sales at Supercars - A Story of Adaptability and Innovation in Business - 29th November 2017

What opportunities lie

within your business when circumstances 'move your cheese'? How adaptable,

flexible and responsive are you to change in your industry?

Does "Mindfulness" Have a Place in Business? - 28th November 2017

Research

has shown that practicing mindful meditation can lead to reduced stress,

lowered blood pressure, increased brain activity, and improved immune response.

It's also been shown to have measurable value for companies when their leaders

and employees practice mindfulness, too.

Here are a few ways taking a more mindful approach to running your business can

lead to greater success.

What is Your Succession Plan? - 22nd November 2017

No matter whether your company has one employee, a hundred or a

thousand, a succession plan is essential to minimise the risk of financial

loss.

Read More

3 Easy and Inexpensive Ways to Look More Professional When You're Starting Out - 14th November 2017

Do you share this habit with the world's most successful business leaders? - 8th November 2017

What do Warren Buffet, Bill Gates, Mark Cuban,

and Arianna Huffington have in common? All of these smart, savvy, successful

business leaders share a passion for self-improvement through reading.

If you want to improve your skills as a business owner, why not spend a bit of

time each day reading books that guide you to greater success?

This reading list of 4 inspiring business books will help you get started:

Tax and Christmas Party Planning - 1st November 2017

Christmas

will be here before we know it, with smarter business owners already planning

their end-of-year festivities. Celebrating the season can be team-building or

just a bit of fun, but the well-prepared business owner will also know that a

little tax planning can help make sure there's no unforeseen tax problems.

Is It Better to Buy or Lease a Company Vehicle? - 30th October 2017

If you need a car to operate your business,

you may wonder whether it makes more sense to purchase or lease.

Learn more about the benefits and drawbacks of

buying versus leasing a vehicle for your business:

Immediate Deductions for Start-Up Costs - 11th October 2017

Historically, taxpayers may have been able to claim a deduction for the costs associated with setting up a business or raising finance. Here we share the immediate deductions for your business start-up costs.

The ATO's Occupation Specific Tax Deduction Guides - 4th October 2017

To

save time finding out what you can or can't include as deductions on your tax

return (so you can keep records for us over the income year), the ATO has

developed a suite of occupation specific guides. The guides have been

designed to help taxpayers understand what they can think about including, or

what is completely off the table, as work-related expenses.

Why Sign a Non-DIsclosure Agreement? - 3rd October 2017

.jpg)

Moving to Cloud Accounting is Smart for Business - 19th September 2017

Share Trader or Investor, Trading Stock and Capital Asset - 11th September 2017

Investment products may be held as trading stock by a taxpayer carrying

on a business of share trading or options trading. However, whether a

particular parcel should be treated as trading stock must be determined on a

case-by-case basis.

Do You Need to Lodge Your Tax Return Early? - 6th September 2017

If you are planning to permanently move out of the country before the end of this financial year, you may be able to have your tax return lodged early.

Look Before you Leap: The Small Business CGT Concessions - 4th September 2017

The CGT relief concessions that

are available to small businesses can be very generous. However they can also

be complex and confusing, so knowing a few of the finer details can go a long

way to ensuring your small business can take best advantage of them.

How to Network Successfully with Local Business Owners - 21st August 2017

Save Time in Your Small Business with Appointment Booking Apps - 16th August 2017

Ready to improve productivity while saving yourself the headache of

booking your calendar the old fashioned away?

A scheduling app is a sure fire way to vastly improve day-to-day

operations, streamlining your work day, saving time and reducing costs.

Put an end to time-wasting telephone tag and those

endless back and forth emails with any of these 4 popular scheduling apps.

How to Set Your Small Business Payment Terms - 15th August 2017

Healthy cash flow is important for any business, but particularly for small business owners in those first few "make it or break it" years.

Travel Allowances and Proper Use of the Exception to Substantiate Claims - 1st August 2017

A travel allowance is a payment made to employees to cover accommodation, food, drink or incidental expenses they incur when they travel away from their home overnight in the course of their duties.

Child Death Benefit Recipients and the Transfer Cap - 1st August 2017

The death of a parent is hard on all those involved, however once the grieving has eased, a time comes to address financial matters. One of these issues can be what happens to any superannuation they have left.

Advantages of Digital Signing for your Small Business - 24th July 2017

Electronic signature software offers small business a number of time and cost-saving benefits. If you've considered going paperless but haven't yet made the plunge, here are 6 excellent reasons to start using digital signatures today.

FREE ATO workshops for Small Business - 17th July 2017

Did you know the ATO offers FREE workshops for small business?

Accelerated Depreciation for Small Business - 4th July 2017

In the 2015-16 federal budget, the government increased the small business immediate deductibility threshold from $1,000 to $20,000, which was originally due to end at June 30, 2017. But a law amendment bill has recently been passed by Parliament that extends that measure by 12 months until June 30, 2018, after which the deductibility threshold will revert to $1,000.

Be Prepared: What You Need to Bring to Your Tax Return Appointment - 4th July 2017

If you're coming in soon to

discuss your tax return for yourself or your business, be prepared.

Here is a brief general checklist

of things to prepare for your tax return appointment. Not all of the following

will be relevant for everyone, but will depend on your own circumstances. The checklist will help you tick off what you do or don't have in

preparation for your next visit.

How to Kick Some Business Goals this New Financial Year - 29th June 2017

The

start of a new financial year is the perfect time to dust off last year's business plan and

set some new goals for the future.

These tips can help you get started brainstorming how your company can

plan for greater success in the years ahead.

Unexpected Extra Tax to be Levied on Trusts - 13th June 2017

When the then NSW Treasurer, Gladys Berejiklian, delivered her Budget speech on 21 June 2016, she introduced a new foreign investor surcharge on both stamp duty and land tax on residential real estate. The intention was to take the heat off the property market and to raise $1bn.

Read More

End of Year Tax Planning Tips for Business - 7th June 2017

The general rule is that you can claim deductions for expenses your business incurs in its task of generating assessable income. Many of these deductions are obvious - rent, materials, supplies and so on - but there are also some less obvious options left available just before the end of the income year, should your circumstances suit, to further reduce your enterprise's tax burden for the year.

What is a Tax Loss and How Can it be Turned to Good Use? - 7th June 2017

You generally make a tax

loss when the total deductions that can be claimed for a financial year exceed

the total of assessable and net exempt income for the year.

If

you operate a business that makes a loss you can generally carry forward that

loss and claim a deduction for it in a future year. If you're a sole trader or

in a partnership, you may be able to claim business losses by offsetting them

against your other personal income (such as investment income) in the same

income year.

Commutation Requests and ATO reviews: What You Need to Know Before June 30 - 5th June 2017

In

a recently released practical compliance guideline, the ATO sets out its

administration approach in relation to super fund commutation requests. It is

an essential piece of information for SMSF trustees because it explains which

commutation requests will not be subject to an ATO review.

Penalty Unit Increase: 30 More reasons to Make Sure Your Tax Outcome is Right - 5th June 2017

A

piece of legislation that recently made its way through Parliament means that

come July 1, misdemeanors committed by errant taxpayers will become a lot more

costly.

Finding Money Within Your Business - 30th May 2017

Single Touch Payroll is Coming - 9th May 2017

Single Touch Payroll is a government initiative to further streamline business reporting obligations between businesses and the Australian Taxation Office (ATO).

Improving Cash Flow: How to Get Paid Faster - 11th April 2017

The Importance of Documenting Processes and Systems in your Business - 27th March 2017

How to Create Good Habits in Business - 21st March 2017

Active vs passive assets and the small business CGT concession - 1st March 2017

The Missing Click that Counts - 16th February 2017

Sometimes saving money is just a simple click

Getting the Work-Life Balance Right - 17th January 2017

As a small business owner it's hard to juggle your work and outside responsibilities. It's important to run your business effectively and still have a life outside the office.

You need a good balance between work and play for your health and well-being. Small business owners often fall into the trap of working too hard, ending up exhausted from the constant work demands associated with self-employment.

Update Your Business Plan for a New Year - 14th December 2016

As we come into 2017, it's a good time to reflect on your recent business successes - and consider what you'd like to achieve in the coming six to twelve months.

These tips can help you with the process of making plans to help guide your business to greater success.

Tips for Managing Debtors When You're Self-Employed - 22nd November 2016

You've poured passion, time, and money into fulfilling a contract, have agreed on payment terms and invoiced your customer - and then nothing. Days turn into weeks, and you still haven't received payment.

Wondering how to tip the balance of power in your favor? Try these strategies to get paid quickly and avoid non-payment.

Read More

6 Essential Accounting Terms for Small Businesses - 18th November 2016

Want to increase your accounting knowledge so you can have more informed, insightful discussions with your accountant this quarter?

Start right now, with this list of 6 essential accounting terms for small business owners.

Sometimes There is No Tax on Certain Types of Income - 7th November 2016

It is possible to receive amounts that you do not need to tell the taxman about, and don't have to include as income on your tax return. The ATO classifies these into two different categories (or three, if you count "other" as a category).

If you are not sure whether a payment you receive is exempt income, non-assessable non-exempt income or is another type of amount that is not taxable, you can always check with this office.

3 Advantages of Digital Signing for Businesses - 31st October 2016

Digital signing, versus the traditional "wet" signature, has become increasingly popular in recent years. More and more countries across the globe have endorsed the legal validity of digital signing, enabling businesses to digitize entire workflows and further optimise management processes.

Whether you're preparing an employee work agreement, finalising a new client contract, or submitting an invoice, digital signing can prove beneficial in a number of ways.

Here are just three reasons businesses, organisations, and even governments choose digital signing over paper.

Main Causes of Stress for Business Owners & How to Counter Them - 26th September 2016

Wondering how you can stop stress from derailing your productivity, profits, and overall wellbeing? Follow these practical tips for avoiding the main causes of "business burn-out".

From Apple to Avon: Six Inspiring Marketing Successes - 20th September 2016

From Mac computers to make-up, here are six examples of super-strong brands that cornered their markets using different marketing strategies.

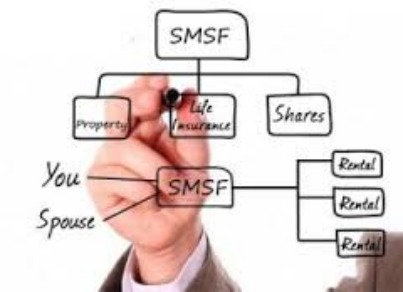

Is an SMSF Right for You? - 19th September 2016

Do-it-yourself superannuation, in one form or another, has been around for about 30 years. But it has only been over the last few years that SMSFs have made an indelible mark on Australia's retirement savings landscape.

By asset value, SMSFs have now surpassed retail and industry super funds.

But is an SMSF right for you?

Read More

Correcting GST Errors and Making Adjustments on Your Business Activity Statements - 5th September 2016

If you identify a goods and services tax (GST) error for a previous period or on an already lodged business activity statement (BAS), there is always scope to make a correction.

Read More

Four Steps to Better Time Management - 29th August 2016

So what can be done about it?

5 Savvy Things to do With Your Tax Refund - 17th August 2016

For many people, their tax refund is treated like a mini lottery win. This tax time, consider putting your "gift" from the ATO to good use.

Baby Boomers and Millennials in Business - 9th August 2016

How to Get Your Business Noticed on a Shoestring Budget - 8th August 2016

These tips will show you five simple ways to promote your local business without breaking the bank.

Key Tips to Keep Your Business Finances in Order - 8th June 2016

However, measuring profitability, creating realistic budgets, and planning ahead for the future are crucial to your professional success.

Follow these four tips to get a handle on the numbers, and take control of your business finances.

Get Up to $250 As A Rebate Against Your Electricity Bill - 1st June 2016

The Family Energy Rebate helps NSW family households with dependent children to cover the costs of their energy bills.

Three Ways Your Accountant Can Save You Money - 30th May 2016

5 Apps for Tracking Small Business Expenses - 25th May 2016

These five apps can be used anywhere, anytime, to ensure no penny goes unlogged or unclaimed.

Bookkeeping Basics for Small Business Owners - 23rd May 2016

Feeling overwhelmed by mountains of paperwork and complex calculations? Here are three bookkeeping basics to help ensure a healthy financial future for your small business.

Tax Tips for New Business Owners - 10th May 2016

Want to avoid paying more than you should come tax time? Set yourself up for success by following these four pillars of painless tax prep.

Growth Hacks for your Small Business - 10th May 2016

Deciding on an online marketing plan can be overwhelming for small business owners looking for affordable ways to nurture steady, sustainable growth. With time in short supply, the key is to find one or two growth strategies that will get results at minimal cost.

The Benefits to Business When They Embrace the "F" Word - 12th April 2016

Research conducted by Galaxy for business solutions provider Citrix reports the Australian economy is missing out on productivity gains worth billions of dollars each year.

Welcome to the AV Chartered Accountants Portal - 7th April 2016

AVCA secure client portal is here!

Connect with us in a secure online space

so that we can collaborate on important documents and accounting tasks with you simply, easily and securely.

Avoid These 5 Costly Accounting Mistakes - 6th April 2016

Most business owners understand that effective financial management is key to their success. But lack of knowledge, frustration, and even avoidance can add up to accounting mistakes that derail future growth. Protect your business and reduce your stress by avoiding these five costly accounting errors.

Job Subsidies Currently Available for Businesses - 29th March 2016

There are a number of job subsidies and grants currently available to employers who hire eligible job seekers including mature age, long-term unemployed, Indigenous, youth or parents.

with AVCA logo.jpg)

Tax Season Tips for Small Business Owners - 24th March 2016

Claiming Business Website Development Costs - 16th March 2016

Most businesses have an online presence - whether to advertise their business or allow customers to purchase goods or services. Here we share how you can go about claiming a deduction for your website development costs.

Read More

Insights from your Profit and Loss account - 15th March 2016

Gain insight into how well your business is performing by understanding your profit and loss account.

Does your business need an ABN? - 3rd March 2016

It's not mandatory for a business to have an Australian business number (ABN), but there are a few good reasons why you should.

Food for (tax) thought, and the GST debate - 25th February 2016

There may be several positives to come out of the government's push for tax reform, with the various submissions to its Re:think initiative from industry and the wider taxpaying community.

Read More

Tax and cyber security: Are you prepared? - 10th February 2016

Since July 2015, scams targeting both individual and business taxpayers have been running rife. Here's how you an protect your business.

Employ New Workers and Receive a Payroll Tax Rebate - 10th February 2016

The Jobs Action Plan is designed to give businesses an incentive to employ new workers and expand their enterprises in both metropolitan and regional areas in NSW.

SuperStream - Free Employer Webinars from the Tax Office - 2nd February 2016

Employers with 19 or fewer members of staff have still got until June 30, 2016 before they need to comply with the new SuperStream standard for superannuation payments.

Have You Thought About the Small Business Pool Write-off? - 20th January 2016

The temporary $20,000 immediate write-off for "small business entities" attracts regular queries, even though it has been many months since the initiative was first announced with the Federal Budget early last year.

Read More

Do You Have What it Takes to Run Your Own Business? - 4th January 2016

Getting your business up and running and making a profit is usually much more difficult than it sounds.

Read More

How to avoid three common profit mistakes this festive season - 8th December 2015

If you are a small business owner experiencing your first Christmas season, it can be a very busy and profitable period.

Read More

2000 Reasons to Consider Hiring a New Employee - 16th November 2015

The Small Business Grant of $2,000 per new employee is a key priority of the New South Wales Government. The grant is designed to encourage the nearly 650,000 small businesses in New South Wales that do not pay payroll tax to hire new employees and expand their business.

Unbundling phone and internet expense claims for work purposes - 5th November 2015

Individuals can claim deductions for mobile, home phone and internet expenses that have been incurred for work purposes.

Read More

Find Your Small Lost Superannuation Accounts - 14th October 2015

A Bill has been introduced into Parliament which contains legislative amendments to increase the account balance threshold below which small lost member accounts will be required to be transferred to the Commissioner of Taxation, i.e. from $2,000 to $4,000 from 31 December 2015, and from $4,000 to $6,000 from 31 December 2016.

Read More

Is Your Business Ready for SuperStream & Standard Business Reporting? - 10th September 2015

We invite you to another informative breakfast hosted by AVCA on some massive changes the Australian Taxation Office (ATO) have coming for businesses in the very near future.

Read More

10 Quick Growth Tips for Your Small Business - 19th May 2015

Small businesses can grow in boom times as well as periods of difficulty by working smarter and taking advantage of opportunities. Put these following effective tips into practise to help grow your business.

Read More

10 Proven Ways to Get More Twitter Followers - 28th April 2015

Social media is a more potent force than ever before and one of the sites at the forefront of the social media revolution is Twitter. With millions of active users, Twitter is an extremely powerful marketing tool. The secret to Twitter success, of course, is growing and then holding a large follower base which can then retweet your own tweets, bringing you even more exposure.

Read More

10 Money Saving Tips for Freelancers - 17th February 2015

While working at home as a freelancer sounds like the ultimate dream for anyone who tires of the rat race, freelancers still have more than their fair share of financial matters to worry about. In fact, perhaps the most important trait that any freelancer should have is the ability to be fully responsible and accountable to themselves, and saving money is something that you will be wholly responsible for.

Read More

Changes to Australia's Credit Reporting System - 18th December 2014

Changes made to the Privacy Act earlier this year brought one of the most significant changes to Australia's credit reporting system in over 25 years.

The introduction of comprehensive credit reporting has changed the level of information held on an individual's credit report to include positive credit information where once upon a time the credit report only reflected negative information.

Read More

Workable New Year resolutions - 8th December 2014

New Year resolutions - we've all made them, and broken them - often before the end of January. There's something about New Year celebrations that makes us yearn for a fresh start, but is there a way to make that desire for change more permanent?

Here's a twist that can make your resolutions more durable, more beneficial and less prone to that embarrassing quick fade.

Read More

Enjoying a stress-free holiday this Christmas - 4th December 2014

As a business owner it's important to take time away from work.

But worrying about whether staff are meeting deadlines and suppliers are happy translates to more stress and less time enjoying your holiday.

With a little staff communication and planning beforehand, you need not worry that your business won't be able to cope in your absence.

Read More

Changes to the Delivery of Business Activity Statements (BAS's) and Instalment Activity Statements (IAS's): Get an AUSKEY! - 1st October 2014

Up to June 2014, every month the Australian Taxation Office (ATO) sent millions of paper BAS's and IAS's to businesses all over Australia. In an effort to save printing costs and to encourage more businesses to engage with the ATO electronically, the ATO changed their practices.

The perfect payroll - The importance of getting it right - 4th July 2014

In the past few days some clients of ours have passed on letters received from their mutual Employer. Apparently their Employer underwent a payroll audit, although the letter does not clarify if the payroll audit was internal or an external audit from the Australian Taxation Office or the Office of State Revenue.

Read More

Self Managed Super Fund Trustees on Notice: New ATO Powers from 1 July 2014 - 1st July 2014

The Australian Taxation Office (ATO) will have new wide ranging powers from 01 July 2014 to deal with Trustees of Self Managed Super Funds (SMSF's) who breach the rules governing super funds. Previously the ATO only ever had powers to ignore the breach or to heavily penalise the Trustees by taxing almost half of their Super Fund. It was an all or nothing approach with nothing in between.

9 Reasons To Switch To Cloud Computing - 20th May 2014

Don't be left up in the air by traditional IT solutions. Check out the top 9 advantages for small businesses switching to cloud computing.

Cloud computing is fast becoming the norm because storing information and using software hosted on the Internet has many advantages.

The natives are revolting - 14th May 2014

Whilst watching the highlights of Smokin' Joe's first budget I couldn't help but think about the French Revolution. I'm not sure how much Tony Abbot and Joe Hockey know about history and a little known event around 1789 where it didn't end well for the "government" of the day when the poor decided to revolt against their lot in life while the rich enjoyed the spoils.

SuperStream - Are you ready? - 5th May 2014

SuperStream is a Government initiative to ensure that all contributions paid by larger employers are paid electronically via SuperStream from 01 July 2014.

Read More

Tax Planning - 30th April 2014

There are many ways in which entities can defer income, maximise deductions and take advantage of other tax planning initiatives to manage their taxable incomes. Taxpayers should be aware that in order to maximise these opportunities, they need to start the year-end tax planning process early. Of course, those undertaking tax planning should be cognisant of the potential application of Pt IVA and any other anti-avoidance provisions. However, if done correctly, tax planning can provide a number of tax savings for entities.

Property rental deductions claims mostly refused - 25th March 2014

An individual has been mostly unsuccessful before the AAT in challenging the Tax Commissioner's decision to refuse a variety of deductions relating to rental properties. The individual, who worked full-time as an industrial chemist, owned rental properties with her husband and had done so for many years. In the 2003, 2004 and 2005 income years, they owned nine rental properties.

Business sale earnout - 26th February 2014

The Coalition government has decided that it will proceed with a long-standing proposal to improve the current tax treatment of earnout arrangements.

Legal expense deductions to fight ASIC charges refused - 23rd December 2013

A stockbroker has been unsuccessful before the AAT in arguing that legal expenses he had incurred in the 2011 income year were deductible.

Read More

Tax debt release based on serious hardship refused - 9th December 2013

The AAT has affirmed the Commissioners decision to refuse to release an individual from his tax liability based on serious hardship grounds. Under the Taxation Administration Act, the Commissioner has a discretion to release an individual from paying a tax liability (in whole or in part) if satisfying the liability would cause that person serious hardship.

Read More

GST refund request made too late - 2nd December 2013

An individual taxpayer has been unsuccessful before the AAT in seeking a review of the Commissioners decision to refuse a GST refund in relation to the June 2004 quarter. The Commissioner had refused the refund on the basis that the taxpayers application was made after the four-year cut-off date for the June 2004 quarter (that is, 28 July 2008).

Read More

Residency requirement for CGT home exemption failed - 25th November 2013

The Administrative Appeals Tribunal (AAT) has denied an individual's claim that an exemption from capital gains tax (CGT) should apply to a property that he and his ex-de facto partner had sold. The individual had purchased land in 2002 with his then partner, and construction of a house on the land commenced in April 2004. However, the couple ended their relationship in September 2004.

Parent liable to CGT on half-share of townhouse - 18th November 2013

An individual has been unsuccessful before the AAT in arguing that he should not have to pay CGT on the sale of a townhouse he owned jointly with his son because, he argued, he was only holding his interest in the property to protect his inexperienced son from selling it on a whim.

Read More

Penalty for unsubstantiated work-related deduction claims - 11th November 2013

The AAT has recently affirmed a decision of the Tax Commissioner to impose a penalty on an individual equal to 50 per cent of the tax shortfall amount arising from deduction claims for work-related expenses that were unsubstantiated.

Read More

Plumbers were full-time casuals, not contractors - 4th November 2013

The AAT has found that individuals working for a plumbing business were employees of the business and that the business was required to provide superannuation contributions for them. The business argued that the workers were independent contractors and that there was no superannuation requirement.

Read More

Beware of artificial trust arrangements to avoid tax - 28th October 2013

The ATO has issued an alert to warn taxpayers that it is aware of arrangements where a discretionary trust is used to effectively funnel large capital gains to a newly incorporated company that is then wound up to avoid paying taxes.

Read More

Tax man refusal of tax debt compromises deal - 21st October 2013

An individual has been unsuccessful before the Federal Circuit Court in seeking a review of the Tax Commissioner's decision to refuse a tax compromise deal. The individual had taken over his father's jewellery business, but said he was not aware of the financial mismanagement of the business until unpaid creditors began calling. The taxpayer argued that the Commissioner had not taken into account the ill-health of his father and the effect the global financial crisis had on the business.

Extra 15% super contributions tax for high income earners - 14th October 2013

The superannuation law has recently been amended so that the effective contributions tax for certain concessional contributions (up to the concessional cap) has been doubled from 15% to 30% for "very high income earners", ie those with income (plus relevant concessional contributions) above a $300,000 threshold.

Read More

GST and adjustment notes - 7th October 2013

The ATO has issued a GST ruling that sets out the requirements for adjustment notes under the GST law. An adjustment note reflects the adjustment to the amount of GST charged on a taxable supply as a result of an adjustment event. An adjustment event will result in the original tax invoice issued by the supplier being incorrect. A supplier is required to issue an adjustment note for a taxable supply unless the supply was issued under a recipient created tax invoice. In that case, the recipient of the supply must issue the adjustment note.

Read More

ATO compliance target areas - 30th September 2013

The ATO has released its compliance program for 2013-2014, setting out key activities and focus areas for the coming year. Some key points include the following:

Read More

Deductions for accommodation and food refused - 16th September 2013

An individual employed by a mining company at Port Hedland on a “fly-in fly-out†basis has been unsuccessful before the Federal Court in appealing an earlier decision that refused his deduction claim of $36,000 for accommodation and food against an allowance.

Read More

CGT small business concessions denied - 9th September 2013

The Administrative Appeals Tribunal (AAT) has held that the exclusion in the tax law from the capital gains tax (CGT) small business concessions for assets used “mainly to derive rent†applies even if the assets are used in “carrying on a business†of deriving rent.

Read More

Individual denied interest deduction - 26th August 2013

Ina recent decision, the Administrative Appeals Tribunal (AAT) hasaffirmed a decision of the Tax Commissioner to deny a taxpayer claim for a personal deduction for interest and bank fees of over$120,000. These were incurred over a two-year period in relation torental properties purchased by a family discretionary trust that hadbeen set up for that purpose, and of which the taxpayer was thetrustee.

Read More

Reasonable travel and meal allowance amounts - 12th August 2013

The ATO has announced the amounts that the Commissioner considers are reasonable for the 2013-2014 income year in relation to claims made for

Read More

Higher contributions cap of $35,000 - 5th August 2013

On1 July 2013, the concessional contributions cap increased from$25,000 to $35,000 for individuals aged 60 years and over. The samethreshold will apply from 1 July 2014 for individuals aged 50 yearsand over.

Extra 15% contributions tax for $300,000+ incomes - 29th July 2013

From 1 July 2012, individuals earning above $300,000 must pay an additional 15% tax on concessional contributions. That is, the effective contributions tax has doubled from 15% to 30% for concessional contributions (up to the cap of $25,000 or, for older taxpayers from 2013-2014, $35,000) made on behalf of individuals above the $300,000 income threshold.

Read More

Individual denied interest deduction - 22nd July 2013

In a recent decision, the Administrative Appeals Tribunal (AAT) has affirmed a decision of the Tax Commissioner to deny a taxpayer’s claim for a personal deduction for interest and bank fees of over $120,000. These were incurred over a two-year period in relation to rental properties purchased by a family discretionary trust that had been set up for that purpose, and of which the taxpayer was the trustee.

Read More

Overseas doctor a tax resident of Australia - 15th July 2013

Adoctor has been unsuccessful before the AAT in arguing that he shouldbe declared a non-resident of Australia for tax purposes. The doctorhad been working in East Timor since 2006 and submitted that heresided in East Timor as that was where he spent his time andlived.

Read More

Partnership denied GST credits - 8th July 2013

The AAT has held that a partnership was not carrying on an enterprise and was not entitled to input tax credits claimed in respect of the relevant period.

Read More